- Gold hit new record highs in the region of $2200 recently.

- This rally came amid mixed sentiment after the release of the US labor market report.

- In this piece, we will look at key levels to buy as a correction looks imminent.

- In 2024, invest like the big funds from the comfort of your home with our AI-powered ProPicks stock selection tool. Learn more here>>

Gold prices soared to historic highs this month, and it looks like the bulls may not be done rallying yet.

This move aligns with a long-term trend and results from several overlapping factors that have favored gold bulls.

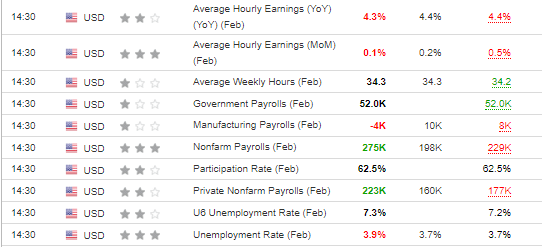

On the other hand, the U.S. labor market report has triggered mixed reactions, making it challenging to predict how it will influence the Fed's future actions.

Additionally, there have been downward revisions to labor market data, but the initial nonfarm payrolls data were positive.

However, there was concern about the unemployment rate in the initial report, which, at 3.9%, represents the highest reading in over a year.

Source: Investing.com

The revisions mentioned earlier significantly lowered the results for January and December, shifting the overall tone of the published data slightly pessimistic.

During the recent House of Representatives report, Jerome Powell did not provide specific statements regarding the timing of the first cut, which wasn't surprising.

However, he confirmed that the cycle of hikes is likely over, and the first cuts may be warranted this year.

The market currently anticipates the pivot to begin in June, which, along with central banks' gold accumulation and lingering geopolitical risks, supports the upward scenario.

Real Estate Sector Under Stress Could Force Fed's Hand

One argument for the Fed to start cutting interest rates as soon as possible could be the potential crisis in the commercial real estate market.

From 2012 to 2022, the commercial real estate (CRE) loan market grew from $1.4 trillion to $2.9 trillion. The situation worsened with the pandemic changing work styles, promoting remote and hybrid work, and reducing the demand for office space.

Additionally, the sharp rise in interest rate levels reduced the profitability and attractiveness of borrowed investments in terms of expected cash flow.

While it may be premature to draw exact parallels with the real estate crisis of less than 20 years ago, the Fed is certainly monitoring the situation and should be ready to act, which could benefit gold.

But, Is a Short-Term Pullback Imminent?

The near-vertical increases in gold prices led to new historical highs of around $2200 per ounce.

Currently, the best-case scenario would be a rebound toward the nearest potential support areas.

In this regard, it is worth paying attention to the area around $2150 and $2100, where we can potentially expect a reaction from the demand side.

The most probable scenario remains bullish with further targets in the round number price levels.

***

Take your investing game to the next level in 2024 with ProPicks

Institutions and billionaire investors worldwide are already well ahead of the game when it comes to AI-powered investing, extensively using, customizing, and developing it to bulk up their returns and minimize losses.

Now, InvestingPro users can do just the same from the comfort of their own homes with our new flagship AI-powered stock-picking tool: ProPicks.

With our six strategies, including the flagship "Tech Titans," which outperformed the market by a lofty 1,183% over the last decade, investors have the best selection of stocks in the market at the tip of their fingers every month.

Subscribe here and never miss a bull market again!

For readers of this article, now with the code: INWESTUJPRO1 as much as 10% discount on annual and two-year Invest ingPro subscriptions.

Do you only use the Investing app? This offer is also for you! InvestingPro for the app now also 10% off with INWESTUJPRO1. Enter discount code TU.

Undervalued stocks, portfolios of the most successful and well-known investors, ProPicks portfolios rebalanced every month - you'll find it all on InvestingPro!

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.