Time to Buy the Dip in European Equities? Here Are Top Names to Scoop Up Right Now

Investing.com | Aug 13, 2024 14:38

- Last week's selloff created buying opportunities in markets outside of the US too.

- Today, we'll explore some high-potential European stocks available at a discount.

- These stocks have decent upside potential and pay dividends as well.

- For less than $8 a month, InvestingPro's Fair Value tool helps you find which stocks to hold and which to dump at the click of a button .

- Strong market capitalization and financial health

- Attractive dividend yields

- Consistent free cash flow

- Fair value that indicates undervaluation

- Analysts' targets above the current price

Recent market volatility sparked panic selling, with many investors echoing concerns about an impending collapse. However, emotional reactions often lead to impulsive decisions and significant financial losses.

Unlike tangible assets, financial instruments derive value from their future potential. While short-term market fluctuations can be unsettling, a long-term perspective is crucial for successful investing.

Just as a sale on clothing doesn't necessarily indicate poor product quality, a stock price decline doesn't always signal a company's failure. In fact, market downturns can present unique buying opportunities for those with a disciplined investment approach.

With that in mind, let’s delve into some promising investment opportunities that have emerged outside of the US following last week’s market selloff.

How to Take Advantage of the Opportunities in the European Market

European companies offer compelling opportunities right now, trading at lower multiples compared to their U.S. counterparts. The STOXX 600 index has gained 8.69% over the past year, a stark contrast to the S&P 500's 19.72% rise.

However, impulsive selling driven by emotions can lead to significant losses, just as hasty buying without strategic planning can be detrimental.

In this volatile environment, focus on quality stocks with robust fundamentals capable of weathering uncertain macroeconomic conditions. Look for companies available at a discount relative to their fair value to maximize potential returns.

Key Parameters to Remember

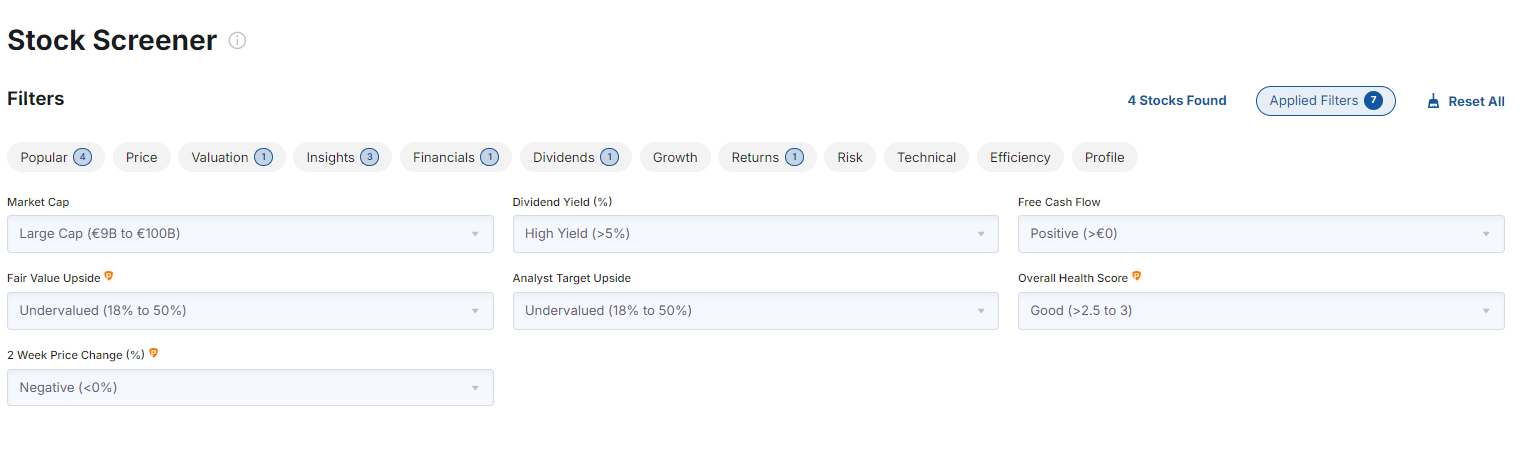

In today's volatile market, focus on quality stocks that can withstand uncertain macroeconomic conditions and are available at a discount. Look for stocks with:

For the criteria, I selected large-cap stocks with market capitalizations between €9 billion and €100 billion, good financial health, high dividend yields (greater than 5%), positive cash flow, and fair value with an upside of 18% to 50%.

Source: Investing.com

Additionally, I filtered for stocks with a negative price change over the past two weeks to capitalize on discounts.

Top European Picks

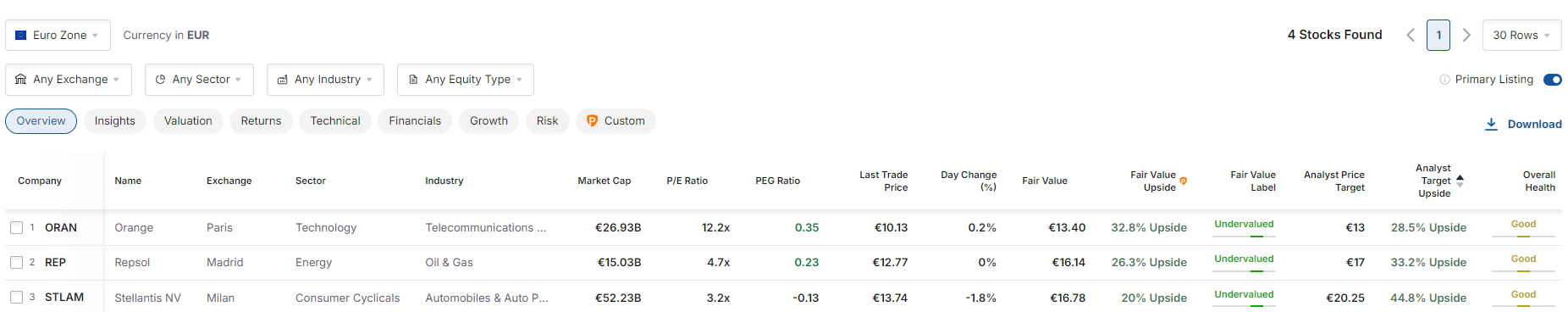

The screen revealed four stocks, all trading at a discount, with dividend yields above 5%, solid financial data, and growth potential. Here are the top three:

Source: Investing.com

Let's analyze them in more detail:

1. Orange

Orange (NYSE:ORAN), a major French telecommunications firm, operates across France, Spain, Europe, Africa, the Middle East, and more. The stock offers a dividend yield of 7.1% and a potential upside of around 30%.

Source: InvestingPro

2. Repsol

Repsol SA (OTC:REPYY), a Spanish multinational energy company, spans 29 countries with interests in oil, gas, and renewable energy. The stock is undervalued with a 26.3% potential upside and offers a dividend yield of 5.8%.

Source: InvestingPro

3. Stellantis

Stellantis (NYSE:STLA), the automaker led by CEO Carlos Tavares, combines several historic brands under one umbrella. The stock has an estimated upside of 22% from its current price and boasts an impressive dividend yield of 11%.

Source: InvestingPro

***

This summer, get exclusive discounts on our subscriptions, including annual plans for less than $8 a month.

Try InvestingPro today and take your investing game to the next level.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, or recommendation to invest and is not intended to incentivize asset purchases in any way. I would like to remind you that any type of asset is evaluated from multiple perspectives and is highly risky; therefore, any investment decision and associated risk remains with the investor.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.