S&P 500, Nasdaq 100 Near Critical Support: Nvidia's Fate to Dictate Next Direction

Michael Kramer | Apr 18, 2024 08:37

Stocks finished the day lower despite an early morning rally attempt. The S&P 500 finished down by almost 60 bps to close at 5,022. The index is nearing that all-important 5,000 big gamma level heading into Friday’s OPEX. That level can offer support at least through Friday; a break of that level before Friday would change the dynamics of the market.

The thing is that there is quite a bit of put delta that has been built in the S&P 500 at 5,200 and 5,100, and presumably, the market makers sold those puts to customers who were the buyers of the puts, and that means for market makers to be hedged, the market makers are short S&P 500. So, as the index drops, market makers are sellers of the index. If the index drops below 5,000, then the selling pressure would increase because those 5,000 puts would go into the money.

(BLOOMBERG)

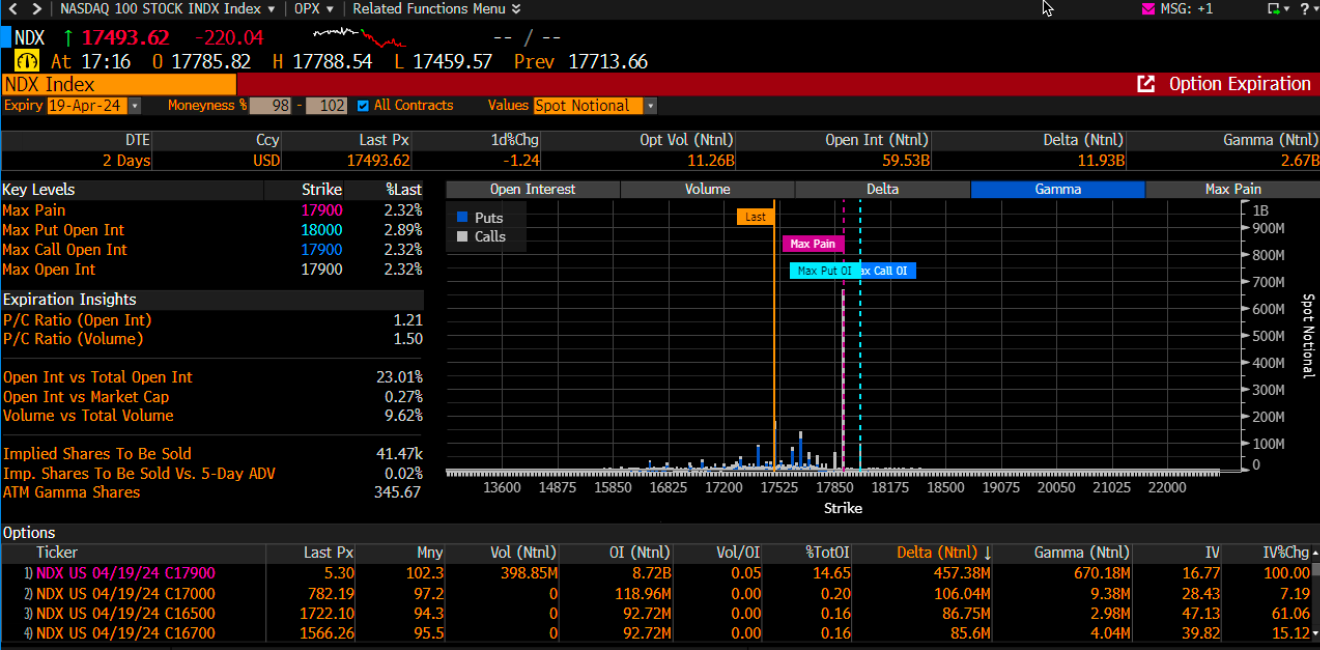

The other dynamic is that this month, when the QYLD ETF goes to cover its NASDAQ 100 calls for expiration on April 19 at the 17,900 strike price on April 18. The impacts from that buyback will be minimal, if at all, felt by the market. The notional delta value for those call options is now a mere $457 million, compared to what has been as big as a notional 5,6,7 or even $8 billion in the past. However, when the new call is sold on Friday, it will create a huge sell imbalance in the market.

(BLOOMBERG)

The NASDAQ has broken below the megaphone pattern, and yesterday it filled the gap from February 21. A break of support at 17,400 would set up a further drop to around 17,100 for starters.

Yesterday, we saw NVIDIA testing and nearly breaking support at $850. That is a significant level because if it goes, the entire market will follow.

Let us face facts, the S&P 500 is up 5.3% on the year, which is 252 points. Of those 252, Nvidia (NASDAQ:NVDA) accounts for 101 points or about 40% of the gains. If Nvidia fell 21% and filled the gap at $670, it would be up 35% on the year.

But right now, it is up almost 70% on the year, so I’d guess that if Nvidia fell to $670 and was up only half as much, it would probably mean that Nvidia would account for 50 points in the S&P 500 and instead of the S&P 500 being up 252 points it might be up 202. Meanwhile, one would think that if Nvidia goes, the other Fab4 would likely go too, and the fact is that the Fab4 represents 80% of the gains so far this year in the S&P 500.

So if Nvidia goes, things would probably get ugly fast.

(BLOOMBERG)

https://youtu.be/lgTZ0od-_Vg?si=qL8AHOhWdR8KmSH-

Original Post

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.