Rates Spark: Science Fiction?

ING Economic and Financial Analysis | Dec 07, 2023 11:08

By Benjamin Schroeder

The 10-Year UST yield is closing in on the 4% mark as if a weak jobs report tomorrow was a given. But underlying is also a further slide of inflation expectations. The front end is lagging, however, and being already priced aggressively for cuts, it will probably need these to become more imminent to rally further

Rates Continue to Decline but the Front End Is Lagging

Market yields continued to drop with the 10-Year UST sinking to 4.11% and 10-Year Bund to 2.2% yesterday. The driver was a weaker ADP private payrolls report, though some will point out that the correlation with the official payrolls data that is due tomorrow is actually negative. Possibly more relevant for the broader picture was the 5.2% figure for third-quarter productivity growth. It facilitated a 1.2% fall in unit labor costs, which is a positive impulse for a Fed still showing concern on inflation. Another supporting factor was a further decline in oil prices, which saw WTI fall below US$70/bbl.

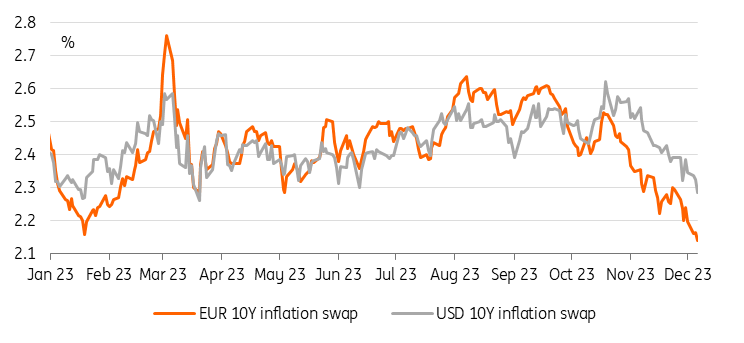

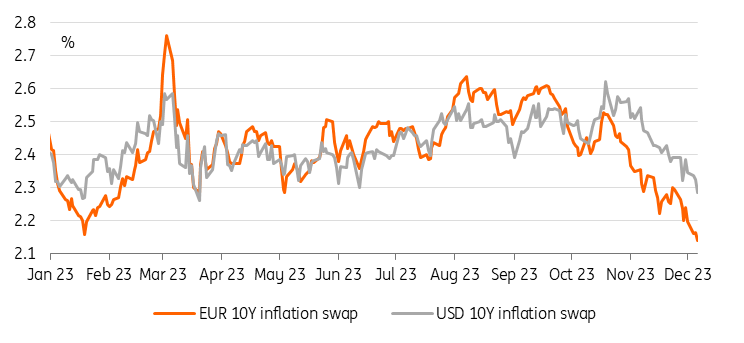

This picture of a reassessment of inflation as a driver does gel with a further slide in inflation swaps, in the US by more than 7bp in 2-Year and close to 5bp in 10-Year. In EUR the drop today was less pronounced, but the overall drop of the 2-Year for instance from a range of around 2.65% over the summer months to now 1.8% speaks volumes.

It is notable in yesterday's session that the already aggressive rate cut discount is struggling to deepen further meaning that curves are inverting more as rates decline. The US saw 2-Year UST yields even rising somewhat to 4.6%. Front-end EUR rates also moved marginally higher.

There was some pushback from the European Central Bank’s Kazimir who called expectations of a March rate cut “science fiction”. A little earlier, the ECB’s Kazaks, who doesn’t see the need for cuts in the first half of next year, did acknowledge that if the situation changes, so might decisions. This is what Executive Board member Schnabel had hinted at as well earlier this week. At the moment the ECB is probably just as smart as the market as it will have to rely on the data. The ECB is right to signal caution and highlight lingering risks, but trying to micro-manage now may only add to market volatility.

Inflation Expectations Have Been Sliding Over Recent Weeks

Today’s Events and Market View

The 10-Year UST yield came close to 4.10% and knocking on the door of the big figure 4% yesterday, before being nudged higher overnight by a weaker 10-Year Japanese government bond auction. Still, the market continues to be expecting Friday's payrolls report to be weak – the softer ADP pointed in the right direction, but markets appear to be overlooking its poor forecasting track record this time around.

There are more US job market indicators to digest today with initial and continuing jobless claims as well as the Challenger job cut numbers. The former may be subject to seasonal volatility around the Thanksgiving holiday season.

In Europe, we will be looking at final third-quarter GDP data as well as scheduled appearances by the ECB’s Holzmann and Elderson.

In government bond primary markets the focus is on the final French and Spanish bond auction for the year. Note that in the US we are still looking at upcoming 3-Year, 10-Year and 30-Year bond sales next week.

Disclaimer: This publication has been prepared by ING solely for information purposes irrespective of a particular user's means, financial situation or investment objectives. The information does not constitute investment recommendation, and nor is it investment, legal or tax advice or an offer or solicitation to purchase or sell any financial instrument. Read more

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.