Q2 Cryptocurrency Review: It Was A Wild And Volatile Quarter; 4 Issues Ahead

Andy Hecht | Jul 05, 2021 11:22

This article was written exclusively for Investing.com

- New highs but a bearish quarter for cryptos

- The leaders move in opposite directions

- Dogecoin was no joke in Q2

- Impressive rise in the number of tokens but dilution too

- What’s ahead for the cryptos?

The second quarter of 2021 was an incredibly wild ride in the cryptocurrency asset class. Bitcoin, which was at five cents per token eleven short years ago, rose to over $65,000. The price of the leading cryptocurrency exploded before imploding.

Bitcoin reaching its peak on Apr. 14, the day that Coinbase Global (NASDAQ:COIN) listed shares on NASDAQ. The stock rose to a high of nearly $430, giving the trading platform an almost $100 billion valuation. At the high, COIN was worth more than the CME and ICE—two established trading platforms. Bitcoin and COIN halved in value following the spike and blow-off highs.

Investors and traders were drawn to the crypto asset class as the magnetic forces of the unprecedented parabolic price action are powerful. The rally ran out of upside steam, leading to price carnage.

As we head into Q3, the libertarian form of money faces challenges, but devotees believe that the price correction is nothing more than a speedbump that creates another buying opportunity. Some opponents continue to believe cryptos are dangerous. Charlie Munger, Warren Buffett’s 97-year-old partner, called them “disgusting and contrary to the interests of civilization.”

Notwithstanding Munger's opinion, when it came to performance, the multi-year bullish trend continued, but the asset class lost value in Q2.

New highs but a bearish quarter for cryptos

While cryptocurrency prices exploded to new highs during Q2, the results were negative on a quarter-to-quarter basis. At the end of Q1, the asset class’s market cap stood at $1.978 trillion as prices were on the way higher, pushing the overall value north of the $2.4 trillion level, eventually reaching an overall market cap north of the $2.4 trillion level during Q2. However, on June 30, the market cap stood at the $1.447 trillion level, down 26.85% during the second quarter.

Bitcoin weighed on the market cap as the leading cryptocurrency dropped by 42.11% from Mar. 31 through June 30, 2021. Bitcoin traded to a high of over $65,500 per token during the quarter but closed just under the $35,000 level as it came to a close.

The leaders move in opposite directions

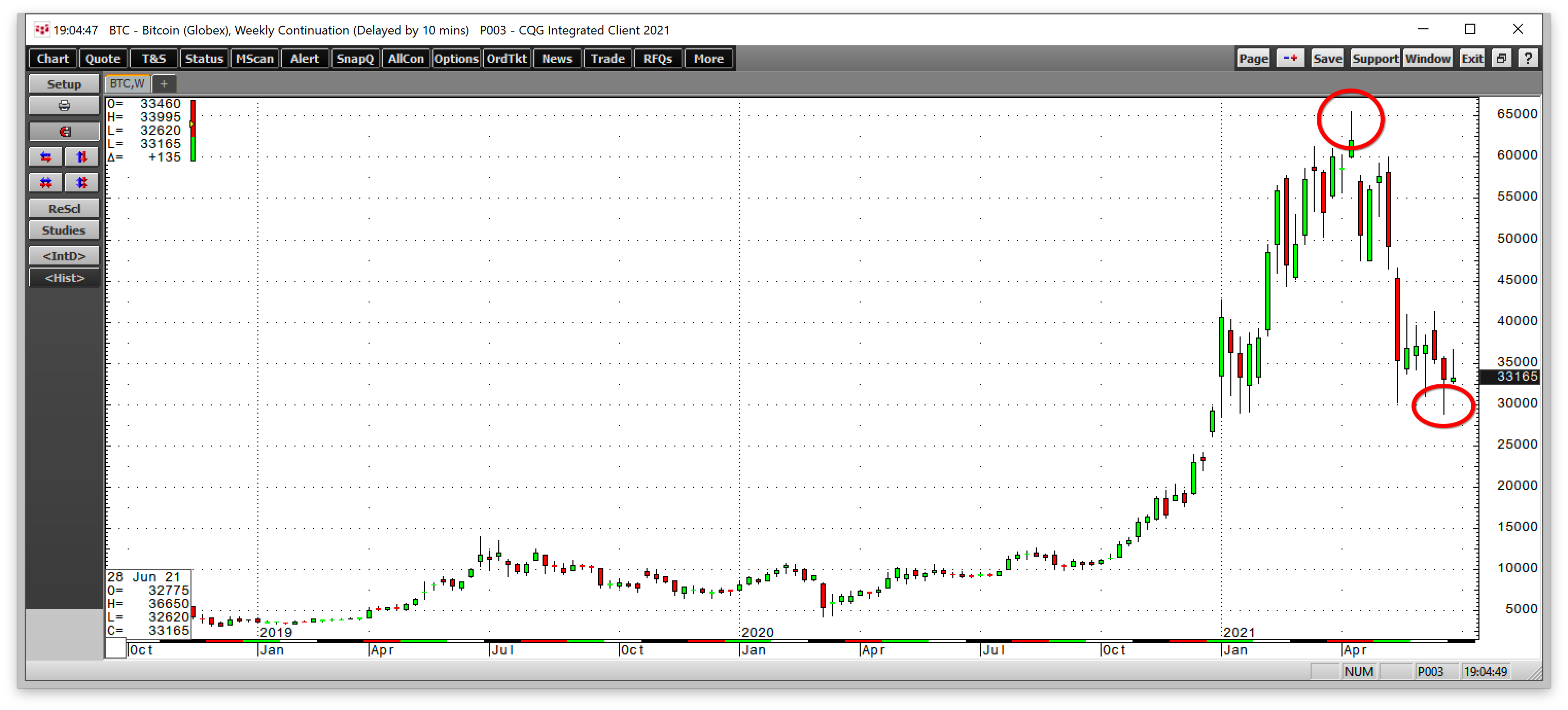

Bitcoin’s price explosion, that took it to a high on Apr.14, then turned into an implosion.

Source: CQG

The chart shows that it took four and one-half months for Bitcoin futures to climb from the $28,800 level to $65,520. In less than half that time, Bitcoin took an express elevator to the downside. At the $35,000 level on June 30, Bitcoin was closer to the low than the high in 2021.

The selling began after Elon Musk decided miners were leaving too much of a carbon footprint, prompting his company, Tesla (NASDAQ:TSLA), to suspend accepting Bitcoin for the automaker’s EVs. However, furious selling came as China cracked down on mining and other activities as the country prepares to roll out its digital yuan.

Bitcoin fell by just over 42% in Q2. While many other tokens followed the leader, Ethereum moved higher in the second quarter, but not before halving in value.

Source: CQG

The weekly chart shows the move that took Ethereum futures to $4,406.50 during the week of May 10 and the collapse that sent the price to a low of $1697.75 in late June. Ethereum settled at the $2265.49 level at the end of June, 16.60% above the level on Mar. 31, 2021.

The leading cryptocurrencies moved in opposite directions in Q2, but both settled closer to the lows than the highs over the period.

Dogecoin was no joke in Q2

Dogecoin (DOGE) began as a joke when it first started trading in late 2013 at around $0.0002047 per token. By Mar. 31, 2021, the price had risen to $0.06199, an impressive gain.

Source:

As the chart shows, DOGE rose to a high of 68.48 cents on May 6 and was trading at the 24.45 cents level on June 30, nearly four times higher in Q2.

DOGE was no joke as Elon Musk and a host of celebrities embraced the cryptocurrency pushing the market cap to the $32 billion level and into sixth place above XRP, Solana, Litecoin, and many other high-flying cryptocurrencies at the end of June.

Impressive rise in the number of tokens but dilution too

The market cap of the asset class may have declined by 26.85% in Q2, but that did not slow the number of new tokens coming to market. As of June 30, 10,725 different cryptocurrencies made up the asset class, up 1,680 or over 18.5% from the end of Q1. At the end of 2020, the number of cryptos stood at 8,153.

The number of cryptos continues to increase, prompting miners and speculators to throw money at new issues hoping to own a piece of the next token that will deliver returns seen in Bitcoin, Ethereum, Dogecoin, and many other leading cryptocurrencies.

Meanwhile, as the market cap declines, the constant flood of new entries dilutes the asset class. Many of the over 10,700 will wind up as dust collectors in computer wallets. However, the speculative fervor will continue until the memories of incredible riches fade into history.

What’s ahead for the cryptos?

As we head into Q3 and the second half of 2021, at least four issues will continue to plague the burgeoning asset class:

- Custody: The custody issue is critical as many market participants will not dip a toe into cryptocurrencies until they are comfortable with storage facilities. ETF or ETN products depend on the ability to store cryptos safely.

- Security: The Colonial pipeline and JBS meatpacking hacks in Q2 are reminders that hackers could breach security and steal cryptocurrency hoards. Security is a crucial issue for the future of the asset class.

- Carbon: Elon Musk spotlighted the carbon issue as miners use massive amounts of computer power, requiring energy to extract cryptocurrencies. Net-zero carbon mining will need to be the goal for new and existing tokens.

- Regulation: This is the thorniest issue facing cryptocurrencies. The ideological gulf between the asset class and government regulators and legislators is a divide that may be too wide for a bridge. The bottom line is governments maintain control and power using a country’s purse strings. Control of the money supply is not something they will surrender without an epic battle. Cryptocurrencies are a libertarian monetary tool. They are pan-global and only reflect bids and offers for value. Central banks, monetary authorities, and governments set the monetary and fiscal policies to stabilize conditions during expansion and contraction periods. Broad adoption of cryptocurrencies could impede their control of the money supply and their power, by extension.

Custody, security, and carbon can be addressed by technology. Regulation and government control are another story. I expect these issues to mount as the asset class’s market cap rises over the coming months and years. As of the beginning of the second half of 2021, governments hope they will not have to address the issue as the market cap dropped. Do not expect them to sit idly by if it begins to rise at a rate seen until April and May 2021.

I see lots of value in blockchain and the cryptocurrency revolution. However, I think we will see it divided into two groups, cryptos and digitals. The cryptos will continue to embrace the libertarian view of money. Digital yuan, dollars, euros, and other currencies, along with a growing number of stable coins, will populate the digitals.

Meanwhile, expect lots of volatility in cryptocurrencies over the coming months as speculative interest will only increase.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.