Gold: Will US Dollar Weakness, Fed Pivot Hopes Push Metal Back Above $2,000?

Investing.com | Nov 16, 2023 10:50

- U.S. inflation has fallen faster than expected and Fed's target is right around the corner

- Meanwhile, gold has rebounded after US dollar's weakening

- But $2,000 remains a key resistance for the yellow metal

- Secure your Black Friday gains with InvestingPro's up to 55% discount !

On Tuesday, inflation data came in only slightly below consensus, garnering a strong response from the financial markets. This not only translated into robust gains in the stock markets but also triggered a depreciation of the U.S. dollar and a decline in Treasury bond yields.

The ripple effect was also felt in gold, which remained within the $1,900-$2,000 per ounce range. Beyond macroeconomic influences, the gold bulls found support from Central Banks, with demand notably up by 14% year-on-year, reaching 800 tons in Q3.

From a technical analysis standpoint, the focal point of resistance continues to hover around the $2,000 mark.

Why Did the Market React So Strongly to the Inflation Data?

Analyzing this year's Consumer Price Index (CPI) data, a consistent trend emerged from March to July, with readings consistently surpassing forecasts by 0.1%, except for March, which saw a 0.2% exception.

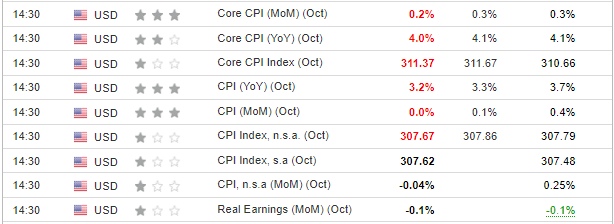

Tuesday's data followed suit, with CPI at 3.2%, slightly edging below the market consensus of 3.3%. Core CPI also performed well, registering at 4%, better than the forecasted 4.1%.

Source: Investing.com

Unlike the March-July period, the market's reaction to the data was intense with effects spilling over to the U.S. dollar, stock indexes, bond yields, and commodities. This moment stands out as the Federal Reserve finds itself on the precipice of a critical decision.

It not only needs to determine the conclusion of the hike cycle but also must signal the possibility of a long-anticipated pivot.

The prevailing market consensus points towards the initiation of monetary easing in May of the upcoming year, and any improvement in inflation data could expedite this anticipated shift.

Gold Bulls Eye Dovish Tone From Fed

The gold market is keeping a keen eye on dovish signals. In a recent analysis, I indicated that a true bull market in gold might still be on hold.

Despite events in Gaza and favorable inflation data, the price hasn't consistently breached the $2,000 per ounce mark, reinforcing the notion that a Fed pivot could be the catalyst for the next bull market.

Taking a longer-term perspective on gold prices, a significant factor in play is the mounting debt of Western economies, spearheaded by the U.S. The current U.S. government debt has already surpassed $33.7 trillion and is projected to increase by another trillion in the near future.

With major foreign buyers showing declining interest, Moody's is sounding the alarm on potential fiscal challenges, a situation that undoubtedly favors gold.

Technical View: Gold Defends Support Level

At the beginning of the week, gold prices defended a local demand zone located in the price region of $1930 per ounce, which means that the recent uptrend has held within a long-term consolidation.

The critical resistance zone lies at the already-tested level of $1970 per ounce. A potential breakthrough here could pave the way for another attempt to breach the psychological barrier of $2,000, a task that may pose challenges in the short term considering the aforementioned factors.

In the event that bulls fail to secure this breakthrough, the likely scenario would involve the continuation of a sideways trend within the range of $1970-$1930.

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple points of view and is highly risky and therefore, any investment decision and the associated risk remains with the investor.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.