Crude Oil Faces a Challenging Year Ahead Despite a Positive Start

Fawad Razaqzada | Jan 20, 2025 13:06

- Crude oil prices are navigating a tug-of-war between geopolitical uncertainty, demand concerns, and shifting energy policies.

- Key technical levels, including the $75 support zone, could dictate the next major move for WTI futures.

- As OPEC adjusts its supply strategy and China’s economic outlook evolves, the longer-term oil price trajectory remains unclear.

- Kick off the new year with a portfolio built for volatility and undervalued gems - subscribe now during our New Year’s Sale and get up to 50% off on InvestingPro !

After rising in the first two and a half weeks of the year, oil prices started show a few signs of weakness around the middle of last week as investors shifted their focus towards Trump’s bearish energy agenda. This came as concerns over demand in China, a major factor in OPEC’s supply quota restrictions last year, were put on the backburner after GDP and industrial production data surprised to the upside last week.

But uncertainty over Chinese demand will linger unless we see a trend of stronger data releases in the coming weeks and months. Meanwhile, the cold weather in the US is also helping to keep demand for fuel elevated, but forecasts of milder weather later in the month is providing a counterbalance to this. Taking

Crude oil faces challenges from several sources

Looking beyond temporary factors such as the weather and weekly inventories reports, the outlook for oil prices is far from great this year.

This year’s oil prices are caught in a tug-of-war between various forces: China’s evolving economic strategies and geopolitical tension, against Trump’s energy policies, that are deemed bearish for oil prices. According to Bloomberg, citing people familiar with the matter, Trump is expected to invoke emergency powers in the hours after he’s sworn in as part of his plan to unleash domestic energy production. Tump has also threatened big tariffs on key trade partners including China, Canada and Mexico, which could hurt demand.

Meanwhile, the OPEC plans to unwind its supply restrictions after several delays. This is another bearish factor for oil prices. On top of this, you have the accelerating global shift towards clean energy, which is a longer-term bearish factor.

So, looking ahead to 2025, the picture remains cloudy, as the upcoming Trump presidency introduces sharp contrasts in trade policies, geopolitics, and economic stimulus plans. These dynamics could push central banks, including the Federal Reserve, towards cautious monetary strategies, potentially stopping it from making further rate cuts amid inflation concerns.

Geopolitics adds another layer of complexity. The Gaza ceasefire is theoretically a bearish factor, but it remains to be seen whether it will bring about a long-term peace solution in the region.

WTI technical outlook: Key levels to watch

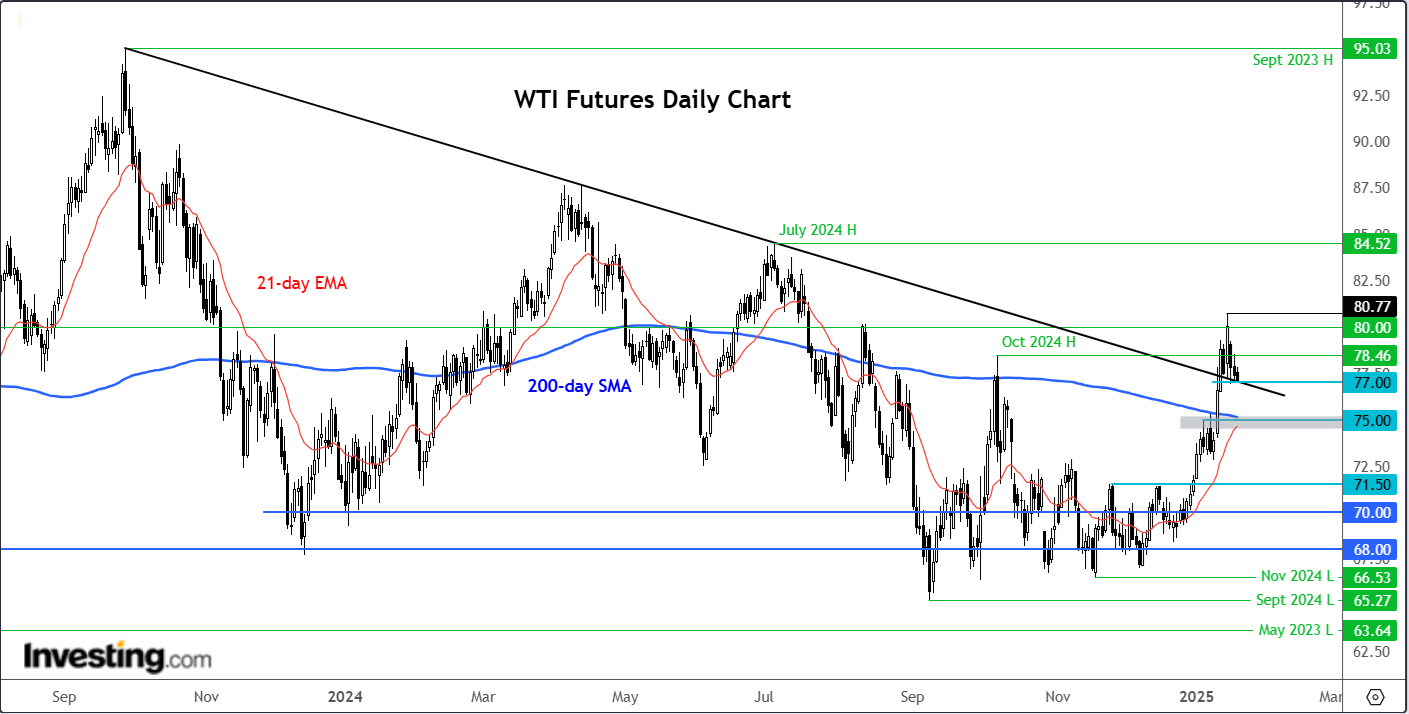

Crude oil prices have been quietly climbing over the past few weeks, but now they face a critical challenge after WTI futures hit resistance last week around the $80 mark. Though we haven’t seen much in the way of downside follow through yet, that could change if prices now go back and hold below the broken trend line and support around $77.00.

Below $77.00, oil prices will be contending with a cluster of technical levels all converging near the $75.00 mark. As well as this level being a psychologically significant zone, the 200-day moving average, and prior support and resistance zones also come into play here.

Therefore, $75.00 is my short-term downside objective as things stand. Whether or not we could see prices dip towards the low $70s again will depend on the bulls’ ability to defend their ground around that $75.00 mark.

In terms of resistance, $78.50, roughly corresponding with the October 2024 high, is an intermediate hurdle en route to that more significant resistance at or around the $80.00 mark.

***

How are the world’s top investors positioning their portfolios for next year?

Don’t miss out on the New Year's offer—your final chance to secure .

Get exclusive access to elite investment strategies, over 100 AI-driven stock recommendations monthly, and the powerful Pro screener that helped identify these high-potential stocks.

Click here to discover more.

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counsel or recommendation to invest as such it is not intended to incentivize the purchase of assets in any way. I would like to remind you that any type of asset, is evaluated from multiple perspectives and is highly risky and therefore, any investment decision and the associated risk remains with the investor.

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.