27.06.23 Macro Morning

Chris Becker | Jun 27, 2023 01:36

The start of a new trading week is not yet translating into stability for risk markets with Wall Street again pulling back led by a decline in tech stocks. European bourses saw mixed returns as well as ECB President Lagarde and other ECB officials brace the continent for more rate rises just as Germany is spiralling into recession with the latest IFO survey looking ominous.

US bond markets saw a small pullback in yields with 10 year Treasuries down to the 3.71% level while oil prices went nowhere again due to economic slowdown concerns with Brent crude holding at the $74USD per barrel level. Gold is struggling but managing to hold at its Friday night level after dropping sharply towards the $1900USD per ounce zone, currently at $1923 this morning.

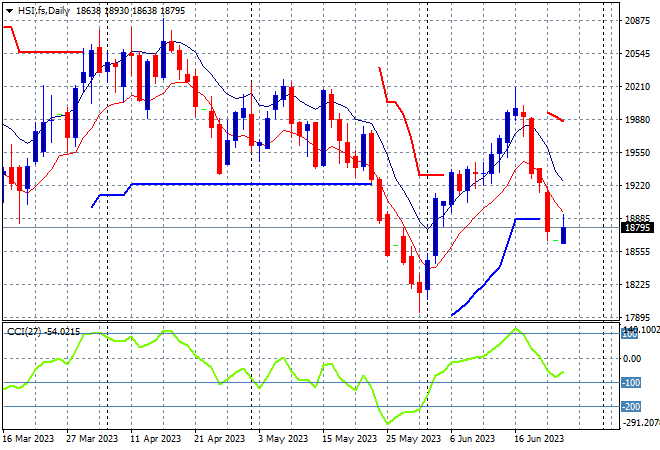

Looking at share markets in Asia from yesterday’s session where mainland Chinese share markets reopened after a long weekend with the Shanghai Composite dropping more than 1.5% to 3150 points while the Hang Seng Index had a smaller loss, down nearly 0.5% to the 18794 point level as the selling continues.

The daily chart was showing a series of strong sessions that took it back above the previous resistance zone as daily momentum became positive and overbought, retracing most of the May losses. However this sharp reversal continues to take price action below that zone with this follow through below the 19000 point level indicative of further falls ahead:

Japanese stock markets were able to hold on due to a weaker Yen with the Nikkei 225 only falling about 0.2% lower to 32698 points. Futures are indicating a further retracement as the new trading week gets underway.

Trailing ATR daily support had been ratcheting higher but with the 33000 point level now broken and daily momentum retracing from overbought settings we could see a further retracement back down to that support zone. A consolidation back to 31000 points is sorely needed to take some heat out:

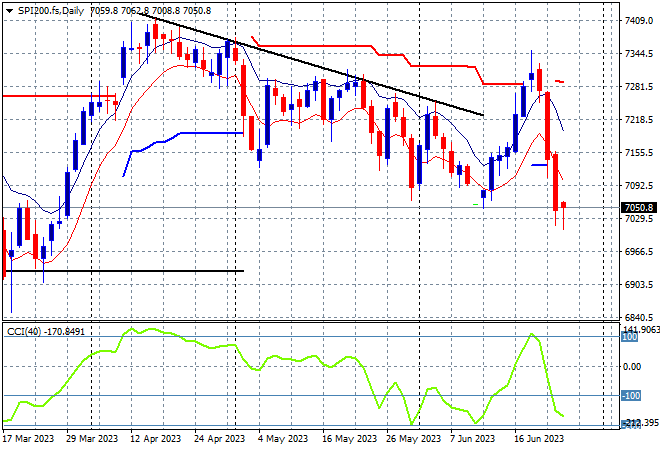

Australian stocks had another small pullback with the ASX200 closing nearly 0.3% lower at 7078 points.

SPI futures are up nearly 0.3% despite tech stocks falling on Wall Street overnight so price action is likely to continue this steep pull back to the recent weekly low. ATR resistance at 7300 points proved too tough a barrier to push through as the medium term price action rolls over completely. The March lows at the 6900 point area could be the terminus for this downtrend:

European markets are trying to find their feet with mixed returns across the continent with a lower DAX keeping the Eurostoxx 50 Index contained, finishing just 0.2% higher at 4280 points.

The daily chart was previously showing a clear breakout that turned into a bull trap but weekly support at 4200 points has so far been well defended. Weekly resistance at the 4350 points level is the true area to beat next with price action indicating a rollover is underway setting up another defense of the 4200 level:

Wall Street was all over the place with industrials coming back slightly while tech stocks slid further lower as the NASDAQ fell back another 1.1% while the S&P500 finished some 0.4% lower at 4328 points.

The four hourly chart shows a decline from the start of last week is still underway as the 4400 point level was taken out on Friday night. Short term momentum remains negative and price action is likely to go lower from here, but is a full correction around the corner?

Currency markets saw consolidation in strength for USD amid the safe haven bid, with Euro contained just above the 1.09 handle after briefly touching the 1.08 level in a swift reversal in Friday night’s session as traders await the outcome of today’s ECB conference.

The union currency is holding here below the point of control from last week’s breakout point where it failed to test the April highs above the 1.10 handle but we could still see a recovery to that level on any “good news”:

The USDJPY pair was able to hold on to its out-sized gains over the weekend, hovering around the mid 143 level despite ever more inflation worries in Japan.

The previous consolidation back down to trailing ATR support was looking like repeating itself here mid week, turning into a medium term consolidation but the BOJ pause and Fed Chair Powell’s comment is giving the pair new life. Four hourly momentum is out of overbought mode but still highly positive as short term price action retraces from a very overdone trajectory:

The Australian dollar is going nowhere as it licks its wounds from the Friday night selloff, still sitting at the high 66 cent level and a new weekly low in the process.

ATR support is a long way away after the Pacific Peso failed to put previous overhead resistance at 67 cents aside with domestic recession concerns and an aggressive Fed overshadowing any attempt at the RBA in managing inflation, so we’re likely to see more downside ahead:

Oil markets continue to oscillate with US recessionary fears and macro concerns amid a higher USD keeping Brent crude around the $74USD per barrel level.

Price remains contained around the December levels and the March lows with daily momentum still negative. A proper reversal will require a substantive close above the high moving average here on the daily chart before threatening a return to $70 or lower:

Gold is trying to stabilise as the new trading week gets underway following its rout on Friday night straight down to the $1910USD per ounce level, with a slight gap higher seeing it return temporarily to the $1920 level but in a very tenuous position.

The daily chart had been showing a continued failure to get back above the psychological $2000USD per ounce level , with short term ATR resistance just too far away on any bounceback. All the signs were building here for a complete capitulation below $1930 so watch for another rollover down to the $1900 level next:

Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.