This post was written exclusively for Investing.com

Earnings season is here, and estimates for the S&P 500 for the first quarter are forecast to fall dramatically versus last year. Expectations for the second quarter are even worse.

The bad news is that those estimates may only continue to decline because some of the bank stocks have already missed results by a wide margin. It will put added pressure on the companies that report results in the weeks ahead to pull through or risk a total collapse of the earnings outlook for 2020 and potentially 2021.

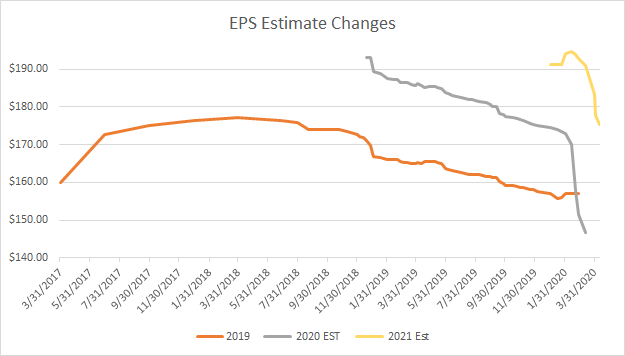

As of April 9, S&P Dow Jones was forecasting first quarter earnings of $34.71 per share for the S&P 500. That is a decline of 8.6% from a year ago.

Meanwhile, earnings for the second quarter are seen falling by 18.3% from the second quarter of 2019. For the full-year, earnings are expected to decline by 6.7% to $146.57 per share versus 2019.

(Data compiled from S&P Dow Jones)

Trending Lower

It seems like a very long time ago, but on December 31, 2019, S&P Dow Jones was forecasting earnings of $175.52 for the S&P 500 in 2020. But those estimates have dropped by 16.5% over the past four months. It is a stunning turn of events in such a brief period.

At the same time, earnings estimates for the first quarter have dropped by 13.9% and by 24.6% for the second quarter. But these have been steadily trending lower for some time and have merely accelerated in recent weeks.

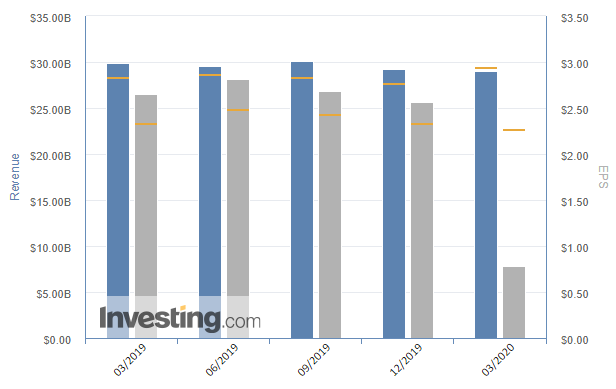

(JPM Earnings and Revenue Results)

Banks Have Set A Weak Tone

Companies like JPMorgan (NYSE:JPM) and Bank of America (NYSE:BAC) missed quarterly earnings estimates by a wide margin. As a result, consensus analysts’ estimates for these companies have taken a further leg lower.

For example, analysts have slashed their earnings estimates for JPMorgan in 2020 by 48.8% over the past month and now see the company earning just $5.44 this year, down from $10.72 per share a year ago.

Bank of America has also seen a meaningful reduction in its earnings estimates with analysts cutting 2020 forecast by more than 36% over the past 30 days to $1.85 per share, a decline of 36.7% from last year.

Technology May Have to Save The Day

It will have to come down to some of the big technology stocks to supply some upside to earnings. To this point, analysts do not see much of an impact on earnings for companies like Apple (NASDAQ:AAPL) or Amazon (NASDAQ:AMZN).

Based on the latest estimates, Apple is forecast to see its earnings rise by 5.2% in 2020 to $12.51 per share. Apple’s estimates have been coming down, but not nearly as much as the bank stocks, with analysts cutting estimates for Apple by just 5.9% over the past month.

Meanwhile, Amazon has seen its earnings estimates trimmed by just 2.4% over the past month, to $28.48 per share. That would give the company an earnings growth rate of 23.8% in 2020. The way the stock has been trading in recent weeks, the market seems to believe there may even be some upside to that outlook, with the shares recently hitting a fresh all-time high.

It’s anyone’s guess just how earnings season will end up going. Still, it seems that if current trends persist, it is likely we see earnings estimates for 2020 continue to decline, especially in this shelter in place environment where the world appears to be held hostage to the coronavirus.

What does seem clear is the importance of the first quarter’s results and the outlook companies provide. It is likely to set the tone for the balance of the year, and potentially the outlook for 2021.

Disclosure: Michael Kramer and the clients of Mott Capital own shares in AAPL.

Disclaimer: Mott Capital Management, LLC is a registered investment adviser. Information presented is for educational purposes only and does not intend to make an offer or solicitation for the sale or purchase of any specific securities, investments, or investment strategies. Investments involve risk and, unless otherwise stated, are not guaranteed. Be sure to first consult with a qualified financial adviser and/or tax professional before implementing any strategy discussed herein. Upon request, the advisor will provide a list of all recommendations made during the past twelve months. Past performance is not indicative of future results.